America is a nation that was, is, and will always be about the money. When push comes to shove, when the rubber meets the road, when it comes down to brass tacks, the deciding factor is always the financial bottom line: Who pays, who profits, who benefits. Few have a problem accepting the premise of the USA being a “free country.” Well, it isn’t exactly “free.” In reality it is barely affordable for most. The grim truth is that the depth of one’s pocket dictates how “free” an individual really is in a consumer-driven economy. It still matters a great deal to lending institutions how well one manages their available financial assets. Carrying large amounts of personal debt is universally viewed as imprudent in most financial circles. Although emergencies and unexpected expenses will inevitably arise and generate legitimate need for quick money, mismanaged credit is too often the driver of excessive personal debt. Among the rank-and-file citizen consumers, bankruptcy is still considered the ultimate debilitating financial setback. Although bankruptcy grants a financial reset for the debtor, it is still looked upon by astute financiers as the basic standard for fiscal dereliction: the result of too many missed payments leading to full default. To the ethically conscious, credibility demonstrated in meeting one’s financial obligations serves as a reflection of a person’s true character. If someone is slack with their monthly bill paying or for meeting any other debts incurred it raises a question as to possible other underlying character deficits. As it has been said by a certain sitting president, “You have to pay your bills.” Nobody deliberately seeks the label of “deadbeat.” This is all easy to understand for anyone who has worked hard to establish good credit and amass wealth. The rules, regulations and expectations of personal finance are fairly clean cut in that no individual citizen is allowed to accumulate perpetual debt. Rules for the federal government however work quite a bit differently.

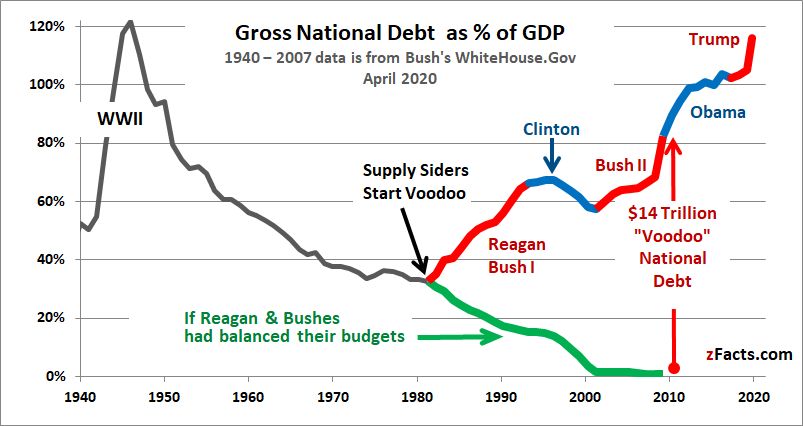

A reasonable question for any concerned taxpaying onlooker is how did the United States come to be some $36 trillion in debt? Although the history of how we became a debtor nation may be viewed as convoluted and nuanced, the basic dynamic driving our debt is not hard to grasp. Some ninety years ago, President Franklin D. Roosevelt, in response to an extended national depression and its fallout, embraced elements of the Keynesian Model of economic management. This provided the government a better means by which to lower unemployment, ease the suffering and elevate the quality of life for the average American. Among the tools available in the Keynesian model was government intervention and deficit spending. The latter is one dynamic that has survived the test of time and has undergone a few tweaks and minor revisions but the basic gist of it is unchanged; the federal government may spend money it doesn’t have into perpetuity. It actually became a useful tool to lift the nation out of depression and later to support industry and production amid a world war. The other side of the equation though was taxation. Few are willing to remember that the highest individual tax rate on income over $200,000 was 94%. That was in 1944 in the midst of the aforementioned world war the outcome of which at the time was not decided. The taxation on corporations remained high through 1972 topping out at 52.8%. Although there was a lingering recession in the mid-1970s into the 80s, the amount of debt held by the American public as a percentage of gross domestic product (GDP) did not rise significantly until the early 1980s (see graph).

If you will note on the above graph, there is a red line starting upward around 1983. That represents the first of the Reagan-era tax cuts which emptied out the treasury and gave everyone, even Yours Truly, a bit of pocket cash back on their weekly paycheck. Nobody it seemed complained at the time. I vividly remember how President Reagan railed against fifty-year-old fiscal policies of “Tax, tax, tax! Spend, spend, spend!” leading many including myself to believe that if there are tax cuts that there will be spending cuts commensurate with them. That was in hindsight naive thinking. Revenue was reduced but spending continued unabated at its previous levels and increased in some areas particularly Defense. Despite multiple attempts at passage, a balanced budget amendment failed muster every time. It was not until the mid-1990s that Congress and President Clinton managed to work together to balance the federal budget and actually have budget surpluses in legislative years 1997 through 2001 (note on the above graph the blue line indicating decline of the debt under Clinton’s tenure). The warm fuzzies so many debt fearmongers had when the nation’s debt briefly declined later proved to be false reassurances when three hijacked commercial jet liners crashed into the twin towers of the World Trade Center and into the Pentagon. That approval of declining debt suddenly took a backseat to the fear of a mushroom cloud when two open-ended overseas military adventures were charged to the national credit card courtesy of the Bush 43 administration. To add insult to injury, the reckless fiscal policies in place for the better part of a decade culminated in the near stock market crash and subsequent financial crisis of 2008. The needs required to keep the nation out of a full-blown depression were such that best intentions regardless of party stripe no longer mattered because at this point the interest on the debt was driving it perpetually upward. Then a mismanaged pandemic response forced even more deficit spending and subsequent increase of what the nation owed. Despite the mess of economic recession created by the pandemic, the USA emerged from it with a fairly healthy and booming economy despite some lingering but manageable issues. Now, on the front end of a non-consecutive second term of a rogue executive whose first term economic policies were dubious and destructive, we find ourselves on the hook for a national balance sheet that shows a debt to GDP ratio of over 122%! That represents more than double the amount left by President Clinton in January 2001. What’s more is his radically crafted and personally approved Big Beautiful Bill has been passed by the House. Now that it is in the Senate, some members of the president’s own party are verbalizing a lot of misgivings about its true cost and benefits. Long story short, if the sitting president’s pet legislation becomes law it will add as much as $5 trillion to the national debt over ten years!

Checking the math on White House and GOP claims about the Big Beautiful Bill

One thing that can run up the tab quickly on any sum of borrowed money is interest, you know, the cost of the loan paid by the borrower to the lender, which is often compounded in addition to other charges and fees. Understanding this concept proved to be a big stumbling block for Yours Truly years ago when the terms of my first car loan were explained even though it was a fairly small loan relative to all the ones I’ve entered into since. I cannot even begin to wrap my head around the amount of interest owed on a debt of $36 trillion, and this president and all his loyal MAGATs who believe wholeheartedly that he is incapable of wrongdoing are totally fine with piling on ever more to it!

My father was a mid-level big bank employee and a very financially responsible man. I am forever grateful for inheriting his disdain for debt. Indeed, I learned early in my childhood the “pay-as-you-go” policy of financial management. I didn’t even possess a credit card until I was thirty years old. I am not ashamed of the fact that I have long had a phobia regarding taking on debt particularly over something I can get along fine without. Financial discipline was much easier for me than a lot of my contemporaries because of a better ability to say “No” because the simple way of living I learned as a child: “If you can’t afford it, don’t buy it.” I truly enjoy being the sort of client that credit card companies do not like because I rarely carry a balance on any card I possess. Practicing sound financial management is one of my better defining personal characteristics. Sadly, I had to accept a long time ago that not everyone embraces my frugal ways. I’m sure much of that has to do with the Yankee consumerist value of “buy now, pay later.” Our national debt has become a malignant liability regardless of how much any or all of us continue to ignore it. Not only has our future but that of Americans whose grandparents are not born yet has been permanently mortgaged. Our sinking financial estate is not sustainable and is eventually going to come crashing down. I do not wish to be under it when it happens. America may still be the Land of the Free, but for the rest of our days it is going to be the Home of the Indebted.

Thank you for reading.

Wow. The truth really does hurt. So the chainsaw to the government budget didn’t help us? Irreparable damage was done years before my kids were even born. It makes me wonder if I considered things rationally when I married and wanted a family. i thought all I had to do was to be sure my spouse and I could provide for them. I was deaf and blind to the larger world. I see my kids now not wanting to have children because I think they are smarter than I ever was. Just…wow.